Most shipping tools are built for one core job: print a label, get the order out the door, and move on.

That works, until it doesn’t.

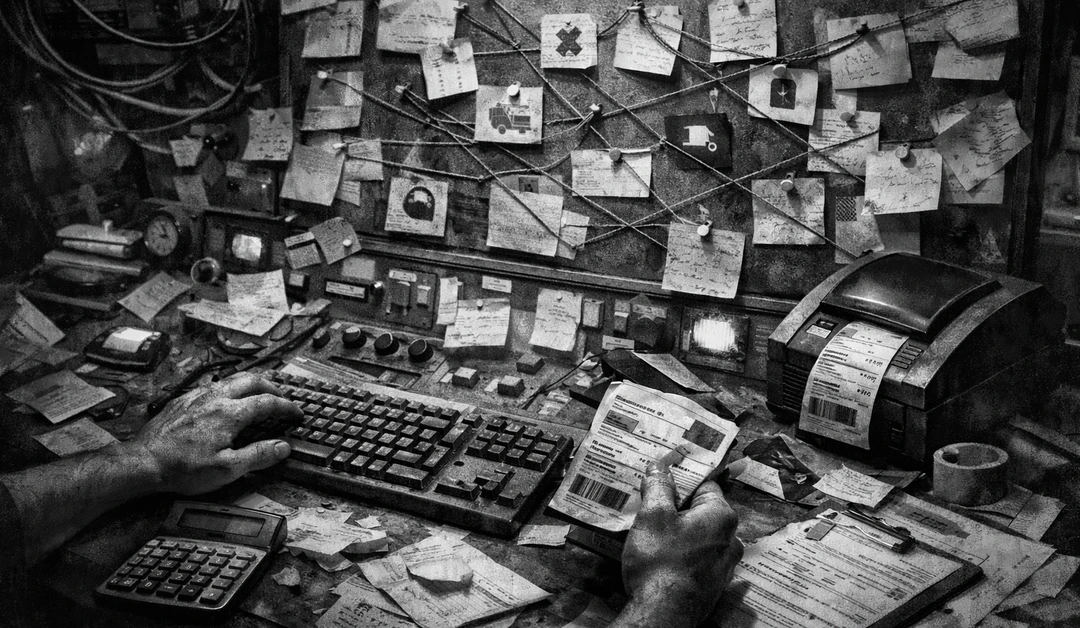

At a certain point, shipping stops being a “label problem” and becomes a coordination problem across carriers, service levels, exceptions, surcharges, packaging, and customer expectations. When that shift happens, the symptoms show up fast: more manual work, more workarounds, more “why did we ship it that way?” conversations, and more pressure on your team.

Below are seven signs you have outgrown your shipping software, plus what to do next if you are feeling the strain.

Sign 1: “Carrier selection” still happens at print time

If your process is basically: rate shop, pick the cheapest label, print, hope, you are operating in reaction mode.

The giveaway is when you routinely discover problems after the fact:

- A “cheap” label creates a service miss

- You upgraded too many orders (and ate margin)

- You under-delivered on a promised timeline

- You get surprise adjustments later (DIM, oversize, address issues)

When shipping decisions only happen at the moment of label creation, you are optimizing the easiest thing to measure (price in that moment), not the outcome you actually care about (service + margin + customer experience).

What to do next: Move from label-time decisions to continuous coordination: carriers + services + data working together to optimize cost and service tradeoffs in real time. That shift is the heart of carrier orchestration.

Sign 2: Your team lives in spreadsheets to “make the system work”

If your best shipping logic lives in:

- Google Sheets

- Slack messages

- A tribal-knowledge playbook

- “Ask Sarah, she knows the rules”

…your software is no longer the system of record. It is just the place where labels come out.

This is one of the most common scale breakpoints: the software is fine for day-to-day shipping, but it cannot keep up with carrier changes, new service options, and customer-specific requirements. So operators build a shadow ops layer around it.

That shadow layer gets expensive fast. It is where mistakes and rework hide.

A real example from a call summary: one operator described the pain of constantly monitoring and changing carriers per order, and how quickly human error creeps in when the process is manual.

What to do next: You need a system that can carry your rules, your constraints, and your decision logic inside the workflow, not alongside it.

Sign 3: Rules have turned into a fragile “rules jungle”

At first, rules feel like progress.

Then you add more carriers. More service levels. More exceptions. More customer promises. More packaging types. And suddenly your “simple automation” is a patchwork of if/then logic that nobody wants to touch.

Common red flags:

- Only one person knows how the rules actually work

- Every carrier change requires an “all hands” explain session

- A small tweak breaks something unexpected

- Your team is afraid to improve routing because it might destabilize operations

Rules are necessary, but static rules alone do not adapt well when conditions change (pricing, performance, capacity, peak constraints, service variability).

What to do next: Keep the rules, but upgrade the decision layer. You want logic that incorporates performance signals, service requirements, and scenario-based tradeoffs, not just price at print time.

Sign 4: You cannot answer “why did we ship it that way?” with confidence

This question shows up from every direction:

- Customer success: “Why did this arrive late?”

- Finance: “Why are adjustments spiking?”

- Ops leadership: “Why did we upgrade all these orders?”

- Your customer: “Why did you use that carrier?”

If your shipping software cannot explain decisions clearly, the org loses trust in the system. And when trust drops, people bypass the system, override more often, and create inconsistency.

This is also where your shipping team starts to feel like firefighters instead of operators.

What to do next: Look for visibility that “tells the story of the day,” including service mix, exception patterns, carrier performance, and the real drivers behind cost and delivery outcomes.

Sign 5: You are missing the analytics that actually change decisions

A dashboard is not the same thing as decision-grade intelligence.

If your reporting is limited to basic spend totals or carrier splits, you are stuck with hindsight, not insight.

What operators really need is analysis that answers questions like:

- Could we have used Ground and still hit the delivery promise?

- Where are we paying for speed that customers do not value?

- Which zones, SKUs, or packaging types trigger the worst adjustments?

- Are certain carriers slipping on first-scan or delivery performance?

- Which service-level rules are creating margin leakage?

One operator put it plainly: they wanted to analyze whether they could ship more efficiently (like Ground instead of 2-day) while still meeting timelines, and keep the savings.

What to do next: Build your reporting around tradeoffs: cost vs service vs risk. A strong orchestration approach replaces “projected savings” narratives with “unrealized savings” analysis and multiple scenarios (aggressive savings, balanced, current service level).

Sign 6: Adding a new carrier feels like a mini project (every time)

In theory, multi-carrier is simple: connect another carrier, start using it.

In real life, it usually becomes:

- Integration work

- Label spec differences

- Service mapping headaches

- Billing complexity

- Operational training

- Customer-specific exceptions

- Support tickets for weeks

When adding carrier optionality is painful, teams stay stuck with less resilient routing, even when performance or pricing changes.

And in 2026, “carrier stability” is not something you can assume. More services, more variability, more exceptions.

What to do next: Treat carriers like a portfolio. The goal is to create optionality across national, regional, consolidator, micro-regional, and international categories, without turning your operation into a science project.

Sign 7: Your shipping tool is isolated from the rest of your operation

Shipping does not live alone.

If your shipping software is not tightly connected to:

- Your WMS (or fulfillment workflows)

- Your OMS

- Your packaging and cartonization logic

- Your billing and chargeback processes

- Your exception management and customer support workflows

…then you get gaps that create manual work, inaccurate rates, and unreliable outcomes.

This is where “great label printing” still produces bad business results.

What to do next: Think in layers. Your execution systems should run the warehouse. Your coordination layer should improve the decisions those systems make, protect outcomes, and reduce chaos as conditions change.

If you are seeing 3+ of these signs, the upgrade is not “new software.” It is a new operating model.

Here is the simplest way to frame it:

- Shipping software helps you execute.

- Carrier orchestration helps you coordinate.

Carrier orchestration is the continuous coordination of carriers, services, and shipping data to optimize cost, service levels, and delivery performance in real time. It is how teams move from reactive shipping execution to outcome-driven decisioning.

That does not mean you need to replace everything overnight. The best teams phase it:

- Foundation: multi-carrier optionality + better visibility

- Intelligence: reporting that drives decisions (not just dashboards)

- Optimization: consistent service-level and margin protection

- Proactive orchestration: fewer surprises, faster adaptation as carriers change

Quick self-assessment (copy/paste for your team)

Check any that feel true:

- We use spreadsheets or Slack to manage carrier logic.

- Rules are fragile and hard to update.

- We cannot explain shipping decisions consistently.

- We over-upgrade or under-deliver more than we want to admit.

- Carrier changes cause weeks of operational churn.

- Reporting exists, but it does not change decisions.

- Shipping feels reactive and stressful most weeks.

If you checked 3 or more, you are probably past “shipping software” and into “coordination system” territory.